Mechanical and Electrical Contractors Market Report – UK 2019-2023

Available as an Instant Download PDF

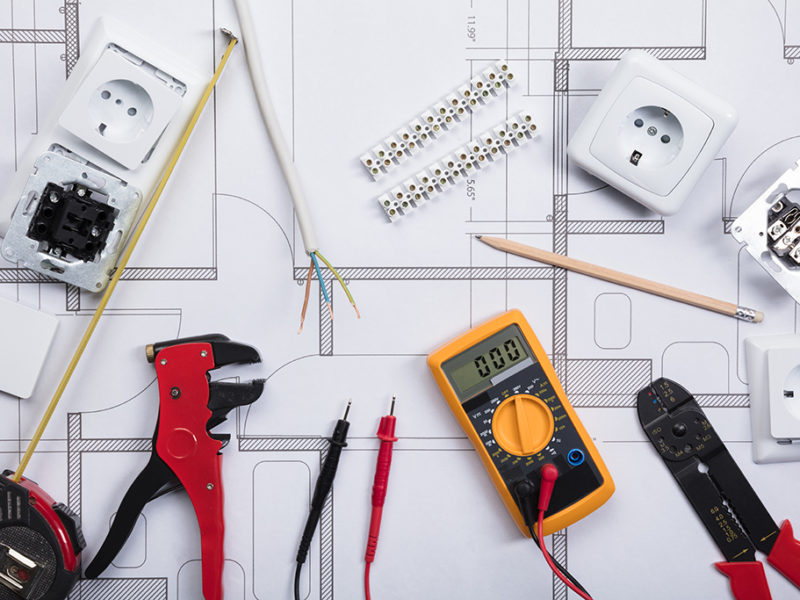

The 5th edition of the ‘Mechanical & Electrical Contractors Market Report – UK 2019-2023‘ has been published by AMA Research. The report addresses the market for mechanical and electrical contractors, focusing on multi-service M&E contracting companies.

£1,599.00 Exc. VAT

Key issues covered in the report:

- Detailed analysis and insight – key trends and demand for M&E services.

- Key influences including analysis of construction trends and regional analysis.

- Market structure and analysis of the leading M&E contractors.

- Product development and growth areas.

- Customers and key end-use sectors.

- Forecasts of market developments up to 2023 – market size and factors impacting on the market.

Areas of particular interest include:

- Market performance review and forecasts to 2023. Features of this market include a highly competitive landscape with a large number of companies operating in the sector.

- Factors affecting the market and analysis of key market characteristics. Impact of energy efficiency and renewable energy incentives and resulting product developments.

- Review of leading contractors and market shares. A fragmented sector covering FM providers, building contractors or energy providers, for which M&E contracting forms a small part of the business.

- Review of key trends – with a focus on key end use markets. Focus of M&E contractors at a regional and national level, specific end-use sectors of the market, range of services offered and how this varies significantly between businesses.

- Impact of legislation and standards on the market.

- Detailed market data and insight on the mechanical and electrical contractors market by AMA Research, a leading UK provider of construction market intelligence.

Some of the companies included:

Atalian Servest AMK, Balfour Beatty Group, Bancroft, Boulting Limited, Briggs & Forrester Group, CBRE Managed Services, Crown House Technologies, Dodd Group Ltd, Emcor Group (UK) Plc, Engie FM Ltd, Essex Services Group, FES, Galliford Try, Gratte Brothers, Halsall Electrical, Imtech, Integral UK, Interserve, Lorne Stewart, Michael J Lonsdale, Mitie Technical Facilities Management, NG Bailey Ltd, Phoenix ME Ltd, Quartzelec, Quinn Infrastructure Services (formerly MJ Quinn Integrated Services Ltd), SES (Engineering Services), Skanska Rashleigh Weatherfoil, SPIE Ltd, SSE Contracting, T Clarke, UK Power Network Services (Commercial), Vinci, and more.

The Market

- Market performance review and forecasts to 2023. Features of this market include a highly competitive landscape with a large number of companies operating in the sector.

- Factors affecting the market and analysis of key market characteristics. Impact of energy efficiency and renewable energy incentives and resulting product developments.

- Review of leading contractors and market shares. A fragmented sector covering FM providers, building contractors or energy providers, for which M&E contracting forms a small part of the business.

- Review of key trends – with a focus on key end use markets. Focus of M&E contactors at a regional and national level, specific end-use sectors of the market, range of services offered and how this varies significantly between businesses.

- Impact of legislation and standards on the market.

End Use Sectors

- Construction output by value, with historical trends and forecasts.

- Construction output analysis by end use sector.

- Value of M&E market in each main sector and market mix by end-use sector.

- Key market drivers, influences and prospects.

- Important issues for M&E contractors in each main end user market.

Contractor Review

- Structure of the M&E Contracting market – number of businesses, size of businesses, types of business, geographical coverage including regional analysis.

- Leading M&E Contracting companies – market shares, M&E turnover and origins.

- M&E Contractor company profiles – turnover and profit data, characteristics, ownership, major strengths and weaknesses, key sectors and capabilities.

- Key trends – pre-fabrication, consolidation, integration and diversification.

- Profitability analysis – profit margin and historical trends.

- Mergers & acquisitions within the M&E contracting industry.

Key Market Trends and Influences

- Review of the performance of the construction industry – including regional analysis of output.

- Information about the legislation and standards affecting the market.

- Analysis of government spending.

- Outline of carbon reduction and green energy requirements.

- Information about product development and growth markets.

The market entered a period of sustained growth in 2013 driven by a buoyant new build market, with rising output in the office and infrastructure sectors in particular. This growth continued up to 2017, but the market stagnated in 2018 due principally to declines in the commercial office sector as well as in healthcare and education.

Uncertainty over the outcome of the Brexit process and its impact on the UK economy is a major factor negatively impacting market growth, especially in the commercial non-residential sector, whilst the public sector also faces constraints in public spending and uncertainty over the sources of funding for capital projects since the termination of PFI.

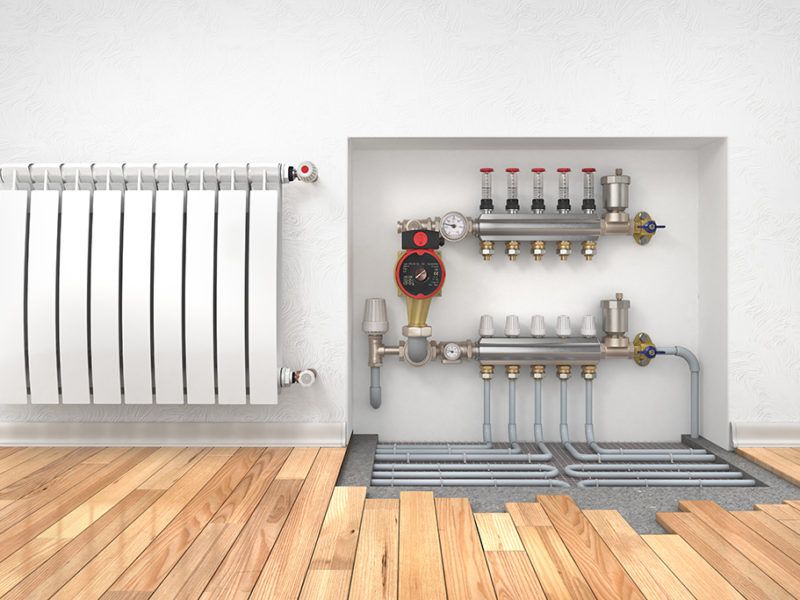

Factors supporting market growth include the introduction of new technologies and products, particularly in the area of energy efficiency and reducing carbon emissions, driven by changing legislation and greater awareness of the issue. There has been a rapid expansion in the range of LED lighting and increasingly sophisticated building control systems for heating, lighting, and energy management.

Other factors stimulating growth are the continued strength in data centre construction and greater levels of outsourcing of M&E services, either singly or as part of wider multi-service FM contracts.

In the private sector, non-residential new work output remains susceptible to changes in levels of business confidence and the uncertainty surrounding Brexit has affected investment in the office sector. However, on the assumption that the outcome of the Brexit process does not have significant adverse effects on the economic climate, some return to modest growth is expected.

The public sector is also expected to see modest growth, though the availability of funding for future projects in healthcare and education is uncertain and the outlook for public sector construction may be unclear until the planned publication of the Government’s Spending Review later in 2019. The infrastructure sector will benefit from HS2 and some larger utilities contracts.

Contents Listing

1. INTRODUCTION 7

1.1 INTRODUCTION 7

1.2 SOURCES OF INFORMATION 7

2. EXECUTIVE SUMMARY & MARKET PROSPECTS 9

2.1 SUMMARY 9

2.2 MARKET PROSPECTS 10

3. ECONOMIC ENVIRONMENT 11

3.1 OVERVIEW AND OUTLOOK 11

3.2 KEY DATA 12

3.2.1 GDP 12

3.2.2 Inflation & Interest Rates 12

3.2.3 Employment & Wages 13

3.2.4 Household Consumption 14

3.2.5 Sterling 15

4. MECHANICAL & ELECTRICAL CONTRACTING MARKET 16

4.1 MARKET DEFINITION 16

4.2 MARKET SIZE & TRENDS 17

4.3 MARKET MIX 19

4.3.1 Mix by Project Type (New Build, RMI, Refurbishment) 19

4.3.2 Mix by Service Type (Electrical, PHVAC, Other) 20

4.4 KEY MARKET INFLUENCES 21

4.4.1 Construction Output 21

4.4.2 Government Spending & PPP/PFI 23

4.4.3 Legislation and Standards 26

4.4.4 Outsourcing of Hard FM and M&E Services 29

4.4.5 Carbon Reduction and Green Energy Requirements 32

4.4.6 Product Development 33

5. REGIONAL ANALYSIS 37

5.1 OVERVIEW 37

5.2 THE NORTH OF ENGLAND 38

5.3 THE MIDLANDS 40

5.4 EAST OF ENGLAND 41

5.5 LONDON & THE SOUTH EAST 42

5.6 THE SOUTH WEST 43

5.7 WALES 44

5.8 SCOTLAND 45

5.9 NORTHERN IRELAND 46

6. KEY END USE SECTORS 47

6.1 OVERVIEW 47

6.2 EDUCATION 48

6.3 OFFICES 49

6.4 INFRASTRUCTURE 50

6.5 ENTERTAINMENT & LEISURE 52

6.6 HEALTHCARE 53

6.7 RETAIL 55

6.8 INDUSTRIAL 56

6.9 OTHER SECTORS 57

7. CONTRACTOR REVIEW 59

7.1 MARKET STRUCTURE 59

7.1.1 Types of M&E Contractors 59

7.1.2 Types of Work Undertaken 61

7.1.3 Geographical Coverage 62

7.2 KEY TRENDS 63

7.3 PROFITABILITY 65

7.4 LEADING M&E CONTRACTING COMPANIES 66

7.5 M&E CONTRACTOR PROFILES 69

7.5.1 Large M&E Contractors (£100m+ M&E Turnover) 69

7.5.2 Medium Sized M&E Contractors (£20m+ M&E Turnover) 76

7.6 PROCUREMENT 80

Tables & Charts

CHART 1: UK MARKET FOR MECHANICAL & ELECTRICAL CONTRACTING 2014 TO 2023 – BY VALUE (£BN) 9

CHART 2: GDP DATA – 2015-2020 – KEY CONSTITUENT ELEMENTS 12

CHART 3: CPI INFLATION AND BANK OF ENGLAND BASE RATE 2008-2023 13

CHART 4: AVERAGE WEEKLY EARNINGS DATA – GB – TOTAL PAY – 2014-2020 (SEASONALLY ADJUSTED) 14

CHART 5: PDI & SAVINGS RATIO AT CURRENT PRICES 2008-2023 14

CHART 6: EXCHANGE RATE FLUCTUATIONS 2015-2021 – STERLING TO THE DOLLAR, AND THE EURO, SPOT RATES 15

TABLE 7: OVERVIEW OF MEP SERVICES 16TABLE 8: UK M&E CONTRACTING MARKET 2014 TO 2023 – BY VALUE (£M) 17

CHART 9: MIX BY TYPE OF PROJECT (NEW BUILD, RMI, REFURBISHMENT) – % BY VALUE 2018 19

CHART 10: MIX BY SERVICE TYPE (ELECTRICAL, PHVAC, OTHER) % BY VALUE 2018 20

CHART 11: CONSTRUCTION OUTPUT (GREAT BRITAIN) NEW WORK & RMI -CURRENT PRICES (£BN) 2014-2023 21

CHART 12: CONSTRUCTION NEW WORK BY END-USE SECTOR BY VALUE 2018 – MARKET £114BN. 22

TABLE 13: PUBLIC SECTOR CAPITAL BUDGET -DEPARTMENTAL EXPENDITURE LIMITS & ANNUALLY MANAGED EXPENDITURE (£BN) 23

TABLE 14: CURRENT PFI PROJECTS ACROSS GOVERNMENT BY DEPARTMENT 2017 24

CHART 15: NUMBER AND COMBINED CAPITAL VALUE OF PFI PROJECTS SIGNED ANNUALLY 2007 TO 2017 25

TABLE 16: PROJECTED SERVICE PAYMENTS UNDER PFI CONTRACTS – 2014/2015 TO 2029/2030 26

CHART 17: UK BUNDLED FM OUTSOURCING MARKET AT CURRENT PRICES 2014-2022 (£BN) 30

CHART 18: UK M&E CONTRACTING REGIONAL SHARES BY VALUE – 2018 37

CHART 19: CONSTRUCTION OUTPUT – REGIONAL SHARES BY VALUE – 2018 38

CHART 20: CONSTRUCTION OUTPUT 2014 – 2018 – NORTH OF ENGLAND – BY CONSTRUCTION TYPE (£M) 38

TABLE 21: NORTH OF ENGLAND – VOLUME OF M&E CONTRACTING ENTERPRISES 2014 & 2018 39

CHART 22: CONSTRUCTION OUTPUT 2014 – 2018 IN THE MIDLANDS – BY CONSTRUCTION TYPE (£M) 40

TABLE 23: THE MIDLANDS – VOLUME OF M&E CONTRACTING ENTERPRISES 2014 & 2018 40

CHART 24: CONSTRUCTION OUTPUT 2014 – 2018 IN THE EAST OF ENGLAND – BY CONSTRUCTION TYPE (£M) 41

TABLE 25: EAST OF ENGLAND – VOLUME OF M&E CONTRACTING ENTERPRISES 2014 & 2018 41

CHART 26: CONSTRUCTION OUTPUT 2014 – 2018 IN LONDON & THE SOUTH EAST – BY CONSTRUCTION TYPE (£M) 42

TABLE 27: LONDON AND SOUTH EAST ENGLAND – VOLUME OF M&E CONTRACTING ENTERPRISES 2014 & 2018 43

CHART 28: CONSTRUCTION OUTPUT 2014 – 2018 IN THE SOUTH WEST OF ENGLAND – BY CONSTRUCTION TYPE (£M) 43

TABLE 29: SOUTH WEST ENGLAND – VOLUME OF M&E CONTRACTING ENTERPRISES 2014 & 2018 44

CHART 30: CONSTRUCTION OUTPUT 2014-2018 IN WALES BY CONSTRUCTION TYPE (£M) 44

TABLE 31: WALES – VOLUME OF M&E CONTRACTING ENTERPRISES 2014 & 2018 45

CHART 32: CONSTRUCTION OUTPUT 2014-2018 IN SCOTLAND – BY CONSTRUCTION TYPE (£M) 45

TABLE 33: SCOTLAND – VOLUME OF M&E CONTRACTING ENTERPRISES 2014 & 2018 46

TABLE 34: NORTHERN IRELAND – VOLUME OF M&E CONTRACTING ENTERPRISES 2014 & 2018 46

CHART 35: UK M&E MARKET SECTOR SHARES BY VALUE – 2018 47

TABLE 36: EDUCATION SECTOR NEW CONSTRUCTION OUTPUT (PUBLIC/PRIVATE) BY VALUE 2014 – 2018 (£M) 48

TABLE 37: OFFICES NEW CONSTRUCTION OUTPUT (PUBLIC/PRIVATE) BY VALUE 2014-2018 (£M) 49

TABLE 38: INFRASTRUCTURE NEW CONSTRUCTION OUTPUT (PUBLIC/PRIVATE) BY VALUE 2014-2018 (£M) 51

CHART 39: UK INFRASTRUCTURE CONSTRUCTION BY TYPE – 2018 (%) 51

TABLE 40: ENTERTAINMENT & LEISURE NEW CONSTRUCTION OUTPUT (PUBLIC/PRIVATE) BY VALUE 2014-2018 (£M) 52

TABLE 41: HEALTHCARE SECTOR NEW CONSTRUCTION OUTPUT (PUBLIC/PRIVATE) BY VALUE – 2014-2018 (£M) 54

TABLE 42: RETAIL NEW CONSTRUCTION OUTPUT (PUBLIC/PRIVATE) BY VALUE 2014-2018 (£M) 55TABLE 43: INDUSTRIAL NEW CONSTRUCTION OUTPUT (PUBLIC/PRIVATE) BY VALUE 2014-2018 (£M) 56

TABLE 44: ENTERPRISES INVOLVED IN M&E ACTIVITIES REGISTERED FOR VAT BY TURNOVER BAND (%) 2014-2018 59

TABLE 45: M&E CONTRACTORS WITH ORIGINS IN POWER/ENERGY 60

TABLE 46: M&E CONTRACTORS WITH ORIGINS IN CONSTRUCTION/CIVILS 60

TABLE 47: M&E CONTRACTORS WITH ORIGINS IN SUPPORT SERVICES/FM 61

TABLE 48: UK ENTERPRISES INVOLVED IN MEP ACTIVITIES REGISTERED FOR VAT BY EMPLOYMENT SIZE BAND – 2018 61

CHART 49: MIX OF VAT REGISTERED BUSINESSES WITH MORE THAN 20 EMPLOYEES BY PRIMARY ACTIVITY 2018 62

CHART 50: VAT REGISTERED BUSINESSES INVOLVED IN MEP SERVICE PROVISION BY REGION (%) – 2018 63

CHART 51: M&E CONTRACTORS’ PROFIT MARGINS 2014-2018 – AVERAGE AND BY M&E TURNOVER SIZE (%) 65

CHART 52: MARKET SHARES BY M&E CONTRACTING TURNOVER 2018 66

TABLE 53: TOP M&E CONTRACTORS IN THE UK MARKET TURNOVER 2018 68

Paired Report Discount

Save £250 for every two reports you buy

Discount applied in basket

Frequently bought together

Trusted by industry leaders

For more detailed requests speak to our research experts directly

Research you can depend on

Our reports go deeper to give you the insights needed to make your next strategic move.

- Detailed assessment of the market – analysis of the market structure and recent developments within the market.

- Market prospects up to 4 years – market value, opportunities, impact of Covid-19, Brexit etc.

- Detailed information – market size, influences, market factors and key players.

- Analysis by product group – market size, product mix, sector trends etc.