Domestic Central Heating Market Report – UK 2018-2022

Available as an Instant Download PDF

The 14th edition of the ‘Domestic Central Heating Market Report’ reviews developments within the industry, with emphasis on both qualitative and quantitative market assessment. Recent trends, key influencing factors and future developments are assessed.

£1,599.00 Exc. VAT

The 14th edition of the ‘Domestic Central Heating Market Report UK 2018-2022‘ reviews developments within the industry, with emphasis on both qualitative and quantitative market assessment – both essential requirements to good marketing planning. Recent trends, key influencing factors and future developments are assessed.

Product sectors covered:

- Overall domestic central heating market size by value 2013-2022.

- Boilers – market size by value, product mix, e.g. combination, traditional, system etc.

- Radiators – standard panel, decorative, towel warmers etc.

- Circulator pumps – stand-alone, boiler-integrated.

- Conventional heating controls and smart heating controls – smart thermostats, learning thermostats etc.

Key areas of insight include:

- Impact of increasing legislation regarding the efficiency and environmental impact of domestic heating systems – Boiler Plus 2018 (boilers and controls), ErP 2018 (reduced NoX emissions for boilers), Part L 2018 (rental properties) etc.

- Development of smart heating controls – enabling remote and flexible control of whole house heating in line with smart home trends.

- Significant market opportunities in the replacement sector – around 30% of UK households with central heating have an inefficient ‘zombie’ non-condensing boiler.

- Impact of new build trends – smart homes, micro flats, increasing use of renewable technologies, product developments to meet legislative requirements etc.

- Detailed market data and insight on the domestic central heating market by AMA Research, a leading UK provider of construction market intelligence.

Some of the companies included:

Alpha, Ariston, Baxi Heating UK, Biasi, Calpeda, Danfoss Randall, Drayton Controls, Ferroli, Glow-worm, Grafton, Grant UK, Grundfos, Heatline, Honeywell, Horstmann, Ideal Boilers, Jaga, Johnson and Starley, Kudox, Lowara UK, MHS Radiators, Pegler Yorkshire, Potterton, Quinn Radiators, Ravenheat, Rettig UK, Saint-Gobain, Salus Controls, Screwfix, Siemens Building Technologies, Smedegard Pumps, Stelrad, Sunvic,TFC Group, The Radiator Company, Travis Perkins, Vaillant Group UK, Vogue UK, Vokera, Wilo UK, Wolseley, Worcester Bosch Group, Zehnder, and more.

Market Overview

- Historical background – influencing factors, legislation, economic influences etc.

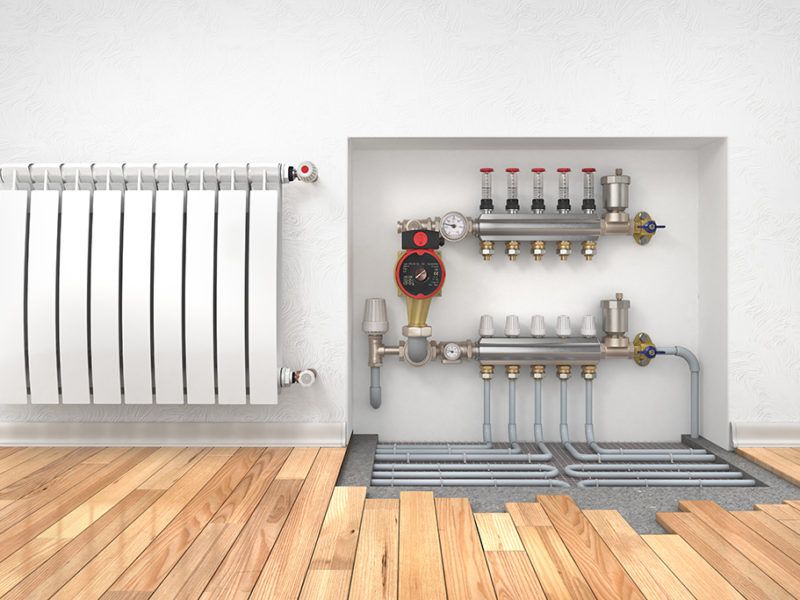

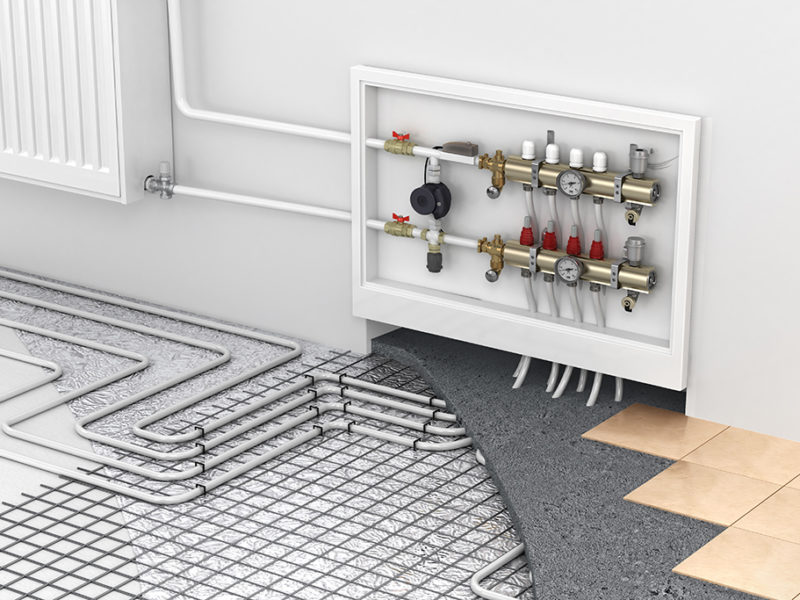

- Market size by value – central heating installations 2013-2018. Market prospects to 2022 and key influencing factors – the Internet of Things, underfloor heating market, insulation trends, environmental legislation, building regulations etc.

- Review of key factors influencing recent growth rates, new housing, legislation, product development etc.

- Product mix – boilers, radiators, pumps, smart controls, conventional controls.

- Ownership levels, penetration by sector, share by type of application. Source of fuel – mains gas, LPG, oil, solid fuel, and electric.

- Renewable energy technologies – 2016 domestic RHI scheme revisions.

Domestic Central Heating Products

- Boiler market size, trends and forecasts to 2022 – legislative changes including 2018 Boiler Plus, Part L, condensing sales, new build trends, impact of renewable heating solutions etc.

- Boiler market share by type of fuel – gas-fired, oil-fired, electric etc. Market mix by location – wall mounted, floor standing, back boiler etc. Product mix by type of boiler – combination, system, traditional etc.

- Radiator market size, trends and forecasts to 2022 – the increasing importance of thermal performance, growth of decorative styles, new build trends, impact of UFH etc.

- Product mix by type of radiator – standard, decorative, towel warmer. Key product trends – design, materials, finish, colour, functionality, and innovation.

- Circulator pump market development and forecasts to 2022 – legislative changes, influence of boiler trends etc. Product mix by type of circulator – stand-alone, boiler-integrated. Key product trends – high efficiency circulators, ErP requirements etc.

- Heating controls market size, trends and forecasts to 2022 – market opportunities, impact of legislation, home ownership, development of smart homes etc.

- Conventional controls product mix and trends – programmers, thermostats, TRVs, motorized valves, compensators etc.

- Smart controls product mix and trends – smart thermostats, learning thermostats, advanced zoned systems etc. Major suppliers – smart and conventional.

Supply & Distribution

- Review of major suppliers in all product sectors – major groups, leading companies, specialist suppliers. Company overview, key products, sectors and financial information.

- Review of distribution structure illustrating direct supply and key channels including major companies operating in each channel.

- Company overview and financials for leading distributors. Major mix by channel – merchants, home improvement multiples, electrical wholesalers, online retailers, other retail, direct from manufacturer, via Big 6 energy provider, OEMs etc.

The UK domestic central heating market is substantial and mature with central heating installed in around 92% of UK homes. However, growth potential still exists, through product innovation designed to improve thermal performance, energy efficiency and control. The UK domestic central heating market has benefited in recent years from increasing health, safety and energy efficiency legislation, revised Building Regulations and environmental legislation. This has stimulated product innovation and development in all sectors of the market.

In 2013, the market for domestic central heating products saw strong growth. This growth can be attributed to the recovery of the UK economy which stimulated new build activity and levels of house moving in particular. Environmental initiatives also supported demand. In 2014 and 2015 the UK domestic central heating market was more subdued, with the lower level of replacement installations impacting on boiler sales in particular. However, the market in 2016 became marginally more positive with demand mainly emanating from private new housing.

The UK domestic central heating market saw growth in 2017 and the outlook in 2018 is similar, largely influenced by the uncertainty surrounding the Brexit process. New legislation such as Boiler Plus will support demand for central heating products overall, in particular domestic boilers and heating controls. The future performance of the UK domestic heating market is likely to be influenced by overall trends in housebuilding, home improvement, fuel prices, energy efficiency legislation, renewable technologies, and technological developments.

- Contents Listing

- 1. INTRODUCTION 7

- 1.1 BACKGROUND 7

- 1.2 SOURCES OF INFORMATION 7

- 2. SUMMARY AND MARKET PROSPECTS 9

- 2.1 SUMMARY 9

- 2.2 KEY TRENDS 10

- 2.3 MARKET PROSPECTS 11

- 3. ECONOMIC ENVIRONMENT & CONSTRUCTION 13

- 3.1 GDP 13

- 3.2 INFLATION & INTEREST RATES 14

- 3.3 UNEMPLOYMENT 15

- 3.4 HOUSEHOLD CONSUMPTION 15

- 3.5 HOUSING 16

- 3.6 STERLING 20

- 3.7 POPULATION PROFILE 21

- 3.8 CONCLUSIONS 21

- 4. UK MARKET FOR DOMESTIC CENTRAL HEATING 23

- 4.1 DEFINITION 23

- 4.2 MARKET OVERVIEW 23

- 4.2.1 Market Size by Value 2013 – 2022 23

- 4.2.2 Product Mix (Boilers, Radiators, Circulators, Heating Controls) 24

- 4.2.3 Household Penetration 25

- 4.2.4 Type of Installation 27

- 4.2.5 Source of Fuel 28

- 4.3 KEY MARKET INFLUENCES 30

- 4.3.1 The Internet of Things 30

- 4.3.2 Underfloor Heating Market 30

- 4.3.3 Insulation Measures 31

- 4.3.4 Environmental Legislation 32

- 4.3.5 Renewable Energy Technologies 34

- 5. BOILERS 35

- 5.1 MARKET OVERVIEW 35

- 5.1.1 Definition 35

- 5.1.2 Market Size by Value 2013 – 2022 35

- 5.2 MARKET TRENDS 36

- 5.2.1 Fuel Used (Gas-fired, Oil-fired, Electric, Other) 36

- 5.2.2 Location (Wall Mounted, Floor Standing, Back Boilers) 37

- 5.2.3 Condensing Boilers 38

- 5.2.4 Boiler Plus Legislation 39

- 5.3 PRODUCT TRENDS 40

- 5.3.1 Product Mix 40

- 5.3.2 Boilers by Type (Combination, Traditional, System, Other) 40

- 5.4 SUPPLIERS 42

- 5.4.1 Market Shares 42

- 5.4.2 Key Company Profiles 42

- 6. RADIATORS 46

- 6.1 MARKET OVERVIEW 46

- 6.1.1 Definition 46

- 6.1.2 Market Size by Value 2013- 2022 46

- 6.1.3 Market Prospects 47

- 6.2 PRODUCT TRENDS 48

- 6.2.1 Product Mix 48

- 6.2.2 Radiators by Type (Standard, Decorative, Towel Warmers) 48

- 6.3 SUPPLIERS 51

- 6.3.1 Market Shares 51

- 6.3.2 Key Company Profiles 51

- 7. CIRCULATOR PUMPS 54

- 7.1 MARKET OVERVIEW 54

- 7.1.1 Definition 54

- 7.1.2 Market Size by Value 2013 – 2022 54

- 7.1.3 Market Prospects 54

- 7.2 PRODUCT TRENDS 55

- 7.2.1 Product Mix 55

- 7.2.2 Circulator Pumps by Type (Stand-alone, Boiler Integrated) 56

- 7.3 SUPPLIERS 57

- 7.3.1 Market Shares 57

- 7.3.2 Key Company Profiles 57

- 8. HEATING CONTROLS 59

- 8.1 MARKET OVERVIEW 59

- 8.1.1 Definition 59

- 8.1.2 Market Size by Value 2013 – 2022 59

- 8.1.3 Market Prospects 61

- 8.1.4 Home Ownership 61

- 8.1.5 Legislative Requirements 62

- 8.1.6 Development of Smart Homes 63

- 8.1.7 Role of the Energy Companies 64

- 8.2 PRODUCT TRENDS 66

- 8.2.1 Conventional Heating Controls 66

- 8.2.2 Smart Heating Controls 69

- 8.3 SUPPLIERS 74

- 8.3.1 Market Shares – Conventional Heating Controls 74

- 8.3.2 Key Company Profiles – Conventional Heating Controls 74

- 8.3.3 Market Shares – Smart Heating Controls 76

- 8.3.4 Key Company Profiles – Smart Heating Controls 76

- 9. DISTRIBUTION 78

- 9.1 CHANNEL SHARES 78

- 9.2 KEY COMPANIES 79

- 9.2.1 Merchants 79

- 9.2.2 Home Improvement Multiples 80

- 9.2.3 Electrical Wholesalers 80

- 9.2.4 Online Retailers and Others 80

- Tables & Charts

- CHART 1: UK DOMESTIC CENTRAL HEATING MARKET BY VALUE AND FORECASTS (£M MSP) 2013-2022 9

- TABLE 2: GDP DATA – 2015-2018 – KEY CONSTITUENT ELEMENTS 13

- CHART 3: INTEREST RATES AND INFLATION (CPI) FROM 2000-2022 15

- CHART 4: PDI & SAVINGS RATIO AT CURRENT PRICES 2000-2022 16

- TABLE 5: RESIDENTIAL NEW HOUSE BUILDING COMPLETIONS 2013-2022 – UK (000’S DWELLINGS) 17

- CHART 6: HOUSEBUILDING COMPLETIONS (ENGLAND) 2008-2018 % MIX BY TYPE OF DWELLING 18

- TABLE 7: RESIDENTIAL PROPERTY TRANSACTIONS IN THE UK (000S) 2013-2022 19

- TABLE 8: EXCHANGE RATE FLUCTUATIONS 2014-2020 – STERLING TO THE DOLLAR, AND THE EURO, SPOT RATES 21

- TABLE 9: UK DOMESTIC CENTRAL HEATING MARKET – BY VALUE (£M MSP) 2013-2022 23

- CHART 10: MARKET MIX BY PRODUCT TYPE (BOILERS, RADIATORS, CIRCULATORS, SMART HEATING CONTROLS, CONVENTIONAL HEATING CONTROLS) BY VALUE 2017 24

- CHART 11: PERCENTAGE OF UK HOUSEHOLDS WITH CENTRAL HEATING – 1996, 2006 AND 2017 25

- CHART 12: PERCENTAGE OF UK HOUSEHOLDS WITH CENTRAL HEATING BY TENURE (OWNER OCCUPIED, PRIVATE RENTED, SOCIAL HOUSING) 2017 26

- CHART 13: NUMBER OF UK HOUSEHOLDS WITH CENTRAL HEATING BY BOILER TYPE – COMBINATION, STANDARD, BACK (000’S) 2017 27

- CHART 14: MARKET MIX BY TYPE OF INSTALLATION (REPLACEMENT, NEW HOUSING, FIRST TIME EXISTING HOUSING) – BY VOLUME 2017 28

- CHART 15: MARKET MIX BY SOURCE OF FUEL USED (GAS, OIL, OTHER ETC.) – BY VOLUME 2017 29

- CHART 16: PERCENTAGE OF UK HOUSEHOLDS WITH INSULATION MEASURES BY TYPE – 1996, 2006 AND 2017 32

- TABLE 17: UK DOMESTIC BOILER MARKET BY VALUE (£M MSP) 2013-2022 35

- CHART 18: BOILER SALES MIX BY TYPE OF FUEL (GAS-FIRED, OIL-FIRED, ELECTRIC, ETC.) – BY VOLUME 2017 37

- CHART 19: BOILER SALES MIX BY LOCATION (WALL MOUNTED, FLOOR STANDING) BY VOLUME 2017 38

- CHART 20: BOILER MIX BY TYPE (COMBINATION, TRADITIONAL, SYSTEM, ETC.) – BY VOLUME 2017 40

- TABLE 21: DOMESTIC BOILER SUPPLIERS % MARKET SHARES – BY VALUE 2017 42

- TABLE 22: UK DOMESTIC RADIATOR MARKET BY VALUE (£M MSP) 2013-2022 46

- CHART 23: RADIATOR MIX BY TYPE (STANDARD, DESIGNER, TOWEL WARMERS) – BY VALUE 2017 48

- TABLE 24: DOMESTIC RADIATOR SUPPLIERS % MARKET SHARES – BY VALUE 2017 51

- TABLE 25: UK DOMESTIC CIRCULATOR MARKET BY VALUE (£M MSP) 2013-2022 54

- CHART 26: CIRCULATOR PRODUCT MIX (BOILER-INTEGRATED, STAND-ALONE) – BY VOLUME 2017 55

- TABLE 27: CIRCULATOR SUPPLIERS % MARKET SHARE – BY VALUE 2017 57

- TABLE 28: UK HEATING CONTROLS MARKET BY VALUE (£M MSP) 2013-2022 59

- CHART 29: SMART & CONVENTIONAL HEATING CONTROLS MARKET BY VALUE (£M MSP) 2013-2022 60

- CHART 30: UK HOUSEHOLD PENETRATION OF SMART HEATING CONTROLS 2017 – 2022 63

- CHART 31: GB ADULTS ACCESSING THE INTERNET WITH A SMARTPHONE 2011 – 2017 64

- TABLE 32: UK BIG 6 ENERGY COMPANIES CUSTOMER BASE AND SMART THERMOSTAT SOLUTION 2017 65

- CHART 33: CONVENTIONAL HEATING CONTROLS PRODUCT MIX BY VALUE 2017 66

- CHART 34: SMART HEATING CONTROLS PRODUCT MIX BY VOLUME 2017 70

- TABLE 35: CONVENTIONAL HEATING CONTROLS – LEADING SUPPLIERS 2017 74

- TABLE 36: SMART HEATING CONTROLS – LEADING SUPPLIERS 2017 76

- CHART 37: MARKET DISTRIBUTION BY CHANNEL DOMESTIC CENTRAL HEATING PRODUCTS – BY VALUE 2017 78

Paired Report Discount

Save £250 for every two reports you buy

Discount applied in basket

Frequently bought together

Trusted by industry leaders

For more detailed requests speak to our research experts directly

Research you can depend on

Our reports go deeper to give you the insights needed to make your next strategic move.

- Detailed assessment of the market – analysis of the market structure and recent developments within the market.

- Market prospects up to 4 years – market value, opportunities, impact of Covid-19, Brexit etc.

- Detailed information – market size, influences, market factors and key players.

- Analysis by product group – market size, product mix, sector trends etc.