Space Heating Market Report – UK 2018-2022

Available as an Instant Download PDF

The 5th edition of the ‘Space Heating Market Report UK 2018-2022’ represents an informed and up-to-date detailed review of the domestic and non-domestic space heating market. The total market for space heating products is substantial, and with climate change and growing concerns about energy efficiency and the environment

The ‘Space Heating Market Report – UK 2018-2022’ costs £945+VAT (if applicable) for a PDF version.

£1,599.00 Exc. VAT

The 5th edition of the ‘Space Heating Market Report UK 2018-2022‘ represents an informed and up-to-date detailed review of the domestic and non-domestic space heating market. The total market for space heating products is substantial, and with climate change and growing concerns about energy efficiency and the environment, space heating products will increasingly be designed to deliver improved thermal performance, in order to achieve lower running costs.

Key areas covered:

- Domestic Space Heating – gas and electric fires; installed electric heating; portables; solid fuel stoves; radiant bar fires.

- Non-domestic Space Heating – commercial and industrial boilers; commercial radiators; heat emitters; warm air heaters; radiant heaters; commercial heating controls.

- Overall market size, trends and forecasts to 2022.

- Detailed market data and insight on the space heating market by AMA Research, a leading UK provider of construction market intelligence.

Specific areas of insight include:

- Impact of increasing legislation – ErP 2018 (reduced NoX emissions for commercial boilers, minimum efficiency standards for domestic local space heaters, commercial warm air heaters and radiant heaters), Part L 2018 (rental properties and buildings), simplified energy efficiency regs.

- Shift in demand for more aspirational domestic space heating products with innovative features and functionality.

- Replacement opportunities in the gas fires and stoves sector – around 11 million UK homes have a chimney and gas supply; also around 5 million inefficient storage heaters 20+ years old.

- Trend towards condensing wall-hung commercial boilers, driven by market demand and legislative changes. Modular boiler systems are also increasing popular, they offer a flexible solution that is more flexible and energy efficient.

- Increasing use of IoT smart heating controls in commercial buildings, to manage energy efficiency and support preventative maintenance measures.

- Widespread roll-out of smart metering in homes and businesses, with increased focus on energy efficient products.

- Growing importance of renewables, with many new commercial projects specifying systems that use energy from renewable sources.

Some of the companies included:

Babcock-Wanson UK, Baxi Heating, Biddle Air Systems, BMM Heaters, BN Thermic, Bosch Commercial and Industrial Heating, British Gas, Byworth Boilers, Caledonian Control Technology, Calor, Clyde Radiators, Cochran, Combat HVAC, Danfoss, Diffusion Heating & Cooling, Dunham-Bush, ELCO, Gas Fired Products, GDC Group, Google, Hamworthy Heating, Honeywell Control Systems, Hoval, Ideal Commercial Heating, IMI Hydronic Engineering, Infraglo, Jaga, Johnson & StarleyJohnson Controls, Kroll, Kudox, Lennox Industries, MHS Radiators, Myson Radiators, Nortek Global HVAC UK, Ormandy, Pegler Yorkshire, Powrmatic, Quinn Radiators, Remeha, S&P Coil, Salus Controls UK, Schneider Electric Controls, Schwank, Secure Controls UK, Siemens Plc, Stelrad, Stokvis, Sunvic Controls, Tacotherm, TFC Group, Thermoscreens, Timeguard, Vaillant, Viessmann, Walney, Zehnder, etc.

Domestic Space Heating:

- Overall market size, trends and forecasts – legislative changes, impact of UFH, insulation measures etc. Ownership levels, source of fuel, imports & exports. Forecasts through to 2022.

- Product mix – gas and electric fires, installed electric heating, portables, solid fuel stoves, radiant bar fires etc.

- Gas and electric fires. Market size, share etc. Product innovation, designs etc.

- Installed electric heating – storage heaters, electric radiators, electric towel warmers, fixed panel heaters, tubular heaters. Market size, trends, market prospects, designs, features etc.

- Portables – fan heaters, convector heaters, portable panel heaters, LPG heaters, oil filled radiators etc. Market size, mix by type, trends, market prospects etc.

- Solid fuel stoves – wood burners and multi-fuel. Market size, growth in sales, product trends, and impact of self build etc.

- Radiant bar fires – gas-fired and electric. Market size, trends etc.

- Major manufacturers – Market share, factors influencing market position, characteristics, turnover etc.o Review of distribution by product group – key channels and developments.

- Market prospects in all product sectors..

Non-Domestic Space Heating

- Overall market size, trends and forecasts. Legislative changes – ErP 2018, Part L, MCPD, EPBD etc. Government initiatives – ECA, Cleaner Heat, ESOS, RHI etc. Impact of IoT. Forecasts through to 2022.

- Commercial boilers > 44kW – market size, market prospects etc. Product trends, features, shift to condensing, modular systems, off-site constructed plant etc.

- Commercial radiators – market size, forecasts, product trends etc.

- Heat emitters – air curtains, fan convectors, fan coil units, perimeter/trench heaters, unit heaters, radiant panel heaters etc. Overall market size, trends, market prospects etc.

- Warm air heaters – indirect-fired warm air heaters, direct gas-fired warm air systems, portable electric warm air heaters etc. Overall market size, trends, market prospects etc.

- Radiant heaters – gas or oil-fired tube heaters, gas plaque and electric radiant heaters etc. Overall market size, trends, forecasts etc.

- Non-domestic heating controls – market size, trends including IoT smart controls, market prospects etc.

- Leading manufacturers – market shares, characteristics, turnover etc.

- Review of distribution by product group – key channels and developments.

The UK space heating market saw good growth in the period 2014-15. Improving levels of consumer and business confidence and expenditure supported value growth at this time. The market situation in 2016 was more subdued with the uncertainty surrounding the UK Brexit vote to leave the EU beginning to impact upon the economy.

However, since then the UK space heating market has remained moderately positive. Key drivers include new housing and replacement purchases, although the outlook for the non-domestic market is very much dependent on the path taken to exit the EU and the type of trade and legislative deals formulated.

In the domestic space heating sector, there has been a shift in demand for more aspirational products, which has supported value growth and retailer margins. In addition, climatic influences such as the relatively cold winter of 2017-18 will support demand for domestic space heating products to some extent.

The non-domestic space heating sector has seen steady improvement in the period 2014-17, with the private sector experiencing higher levels of business investment, particularly in the industrial, offices, retail and leisure sectors.

Other positive influences on the space heating market include the growing concerns about energy efficiency and the environment. The UK Government has introduced a significant amount of environmental legislation in recent years, placing a greater emphasis on carbon emissions and fuel efficiency.

The future performance of the UK space heating market is likely to be influenced by overall trends in housebuilding and construction, RMI activity, fuel prices, energy efficiency legislation, renewable technologies and technological developments.

Contents Listing

- 1. INTRODUCTION 7

- 1.1 BACKGROUND 7

- 1.2 SOURCES OF INFORMATION 7

- 2. SUMMARY AND MARKET PROSPECTS 9

- 2.1 SUMMARY 9

- 2.2 KEY TRENDS 10

- 2.3 MARKET PROSPECTS 11

- 3. ECONOMIC, HOUSING & CONSTRUCTION INFLUENCES 12

- 3.1 GDP 12

- 3.2 INFLATION & INTEREST RATES 13

- 3.3 UNEMPLOYMENT 14

- 3.4 HOUSEHOLD CONSUMPTION 14

- 3.5 HOUSING & CONSTRUCTION 15

- 3.6 STERLING 16

- 3.7 POPULATION PROFILE 16

- 3.8 CONSTRUCTION AND HOUSING 17

- 3.8.1 Non-domestic Construction 17

- 3.8.2 House Building Completions 18

- 3.8.3 Mix of Housebuilding Completions 19

- 3.8.4 House Moving Levels 20

- 3.8.5 Custom Build 21

- 3.9 CONCLUSIONS 22

- 4. SPACE HEATING – DOMESTIC 24

- 4.1 MARKET OVERVIEW 24

- 4.1.1 Definition 24

- 4.1.2 Market Size by Value 2013 – 2022 24

- 4.1.3 Household Penetration 26

- 4.1.4 Source of Fuel 28

- 4.1.5 Imports and Exports (EU, Non-EU) 29

- 4.2 KEY MARKET INFLUENCES 30

- 4.2.1 Domestic Central Heating Market 30

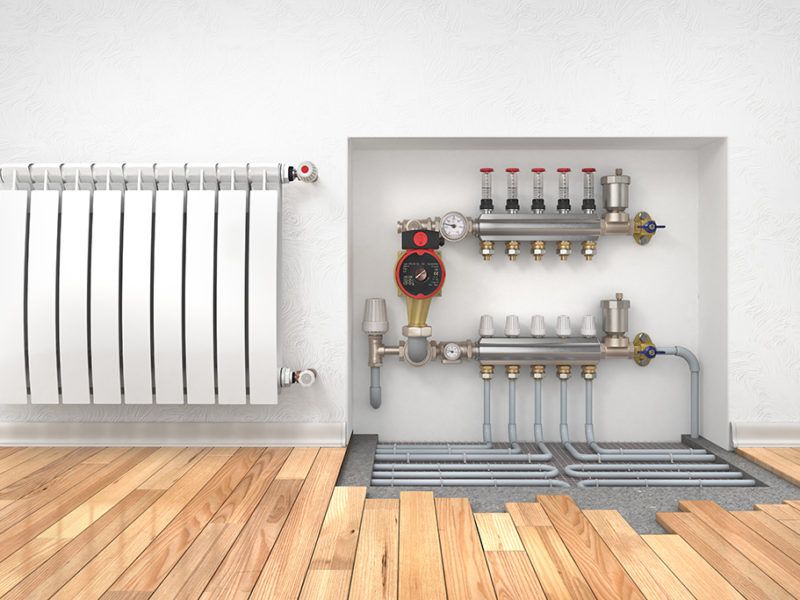

- 4.2.2 Underfloor Heating Market 31

- 4.2.3 Insulation Measures 32

- 4.2.4 Environmental Legislation 33

- 4.3 PRODUCT TRENDS 35

- 4.3.1 Product Mix 35

- 4.3.2 Installed Electric Heating 36

- 4.3.3 Gas & Electric Fires 38

- 4.3.4 Portable Space Heating 43

- 4.3.5 Radiant Bar Fires 45

- 4.3.6 Solid Fuel Stoves and Fires 45

- 4.4 SUPPLIERS 47

- 4.4.1 Market Shares 47

- 4.4.2 Key Company Profiles 47

- 4.4.3 Other Suppliers 49

- 4.5 DISTRIBUTION 52

- 5. SPACE HEATING – NON-DOMESTIC 54

- 5.1 MARKET OVERVIEW 54

- 5.1.1 Definition 54

- 5.1.2 Market Size by Value 2013 – 2022 54

- 5.2 KEY MARKET INFLUENCES 56

- 5.2.1 Energy Efficiency Schemes (ECA, CRC, ESOS, RHI, Cleaner Heat) 56

- 5.2.2 Environmental Legislation 58

- 5.2.3 The Internet of Things 59

- 5.3 PRODUCT TRENDS 60

- 5.3.1 Product Mix (Heating Systems, Stand-alone Heaters, Heating Controls) 60

- 5.3.2 Commercial Heating Systems (Boilers, Radiators, Heat Emitters) 61

- 5.3.3 Stand-alone Heaters (Warm Air Heaters, Radiant Heaters) 67

- 5.3.4 Heating Controls 69

- 5.4 SUPPLIERS AND MARKET SHARES 71

- 5.4.1 Commercial Heating Systems (Boilers, Radiators, Heat Emitters) 71

- 5.4.2 Stand-alone Heaters (Warm Air Heaters, Radiant Heaters) 76

- 5.4.3 Heating Controls 78

- 5.5 DISTRIBUTION (COMMERCIAL HEATING SYSTEMS, STAND-ALONE HEATERS) 80

Tables & Charts

- CHART 1: UK SPACE HEATING MARKET BY VALUE (£M MSP) 2013-2022 9

- TABLE 2: GDP DATA – 2015-2018 – KEY CONSTITUENT ELEMENTS 12

- CHART 3: INTEREST RATES AND INFLATION (CPI) FROM 2000-2022 14

- CHART 4: PDI & SAVINGS RATIO AT CURRENT PRICES 2000-2022 15

- TABLE 5: EXCHANGE RATE FLUCTUATIONS 2014-2020 – STERLING TO THE DOLLAR, AND THE EURO, SPOT RATES 16

- CHART 6: GB NON-RESIDENTIAL CONSTRUCTION OUTPUT NEW WORK AND RMI 2013 TO 2022 – BY VALUE (£ BILLION AT CURRENT PRICES) 17

- CHART 7: NON-RESIDENTIAL NEW CONSTRUCTION OUTPUT ANALYSIS BY SECTOR 2017 AND H1 2018 – % BY VALUE 18

- TABLE 8: RESIDENTIAL NEW HOUSE BUILDING COMPLETIONS 2013-2022 – GB (000’S DWELLINGS) 19

- CHART 9: HOUSEBUILDING COMPLETIONS (ENGLAND) 2005-2018 % MIX BY TYPE OF DWELLING 20

- TABLE 10: RESIDENTIAL PROPERTY TRANSACTIONS IN THE UK (000S) 2013-2022 21

- TABLE 11: UK DOMESTIC SPACE HEATING MARKET (£M MSP) 2013-2022 24

- CHART 12: NUMBER OF HOUSEHOLDS WITH SPACE HEATING AS MAIN HEATING SYSTEM IN ENGLAND 2005 – 2017 27

- CHART 13: PERCENTAGE OF UK HOUSEHOLDS WITH SPACE HEATING AS MAIN HEATING SYSTEM BY TENURE 2017 28

- CHART 14: MARKET MIX BY SOURCE OF FUEL (ELECTRICITY, GAS, SOLID FUEL) BY VALUE 2017 29

- TABLE 15: IMPORTS AND EXPORTS OF DOMESTIC SPACE HEATING PRODUCTS 2017 (£M) 30

- CHART 16: PERCENTAGE OF UK HOUSEHOLDS WITH CENTRAL HEATING – 1996, 2006 AND 2017 31

- TABLE 17: UK UNDERFLOOR HEATING MARKET BY VALUE (£M MSP) 2015-2019 31

- CHART 18: PERCENTAGE OF UK HOUSEHOLDS WITH INSULATION MEASURES BY TYPE – 1996, 2006 AND 2017 33

- CHART 19: MARKET MIX BY PRODUCT TYPE (GAS & ELECTRIC FIRES, STOVES, INSTALLED ELECTRIC HEATING, RADIANT BAR FIRES, PORTABLES) BY VALUE 2017 35

- CHART 20: GAS AND ELECTRIC FIRES MARKET MIX BY VOLUME 2001 AND 2017 39

- TABLE 21: FEATURES AND BENEFITS OF ELECTRIC FIRES 40

- TABLE 22: FEATURES AND BENEFITS OF GAS FIRES 41

- CHART 23: PORTABLES MARKET MIX BY PRODUCT TYPE (FAN HEATERS, PORTABLE PANEL, CONVECTOR, LPG, OTHER) BY VOLUME 2017 43

- TABLE 24: SOLID FUEL STOVES – CURRENT AND ECODESIGN EMISSION LIMITS 46

- TABLE 25: DOMESTIC SPACE HEATING SUPPLIERS % MARKET SHARES BY VALUE 2017 47

- CHART 26: MARKET DISTRIBUTION BY CHANNEL (RETAIL SECTOR, TRADE DISTRIBUTION, OTHER) BY VALUE 2017 52

- TABLE 27: UK NON-DOMESTIC SPACE HEATING MARKET (£M MSP) 2013-2022 54

- CHART 28: MARKET MIX BY PRODUCT TYPE 2017 61

- TABLE 29: UK COMMERCIAL AND INDUSTRIAL BOILER MARKET (£M MSP) 2013-2022 62

- TABLE 30: UK COMMERCIAL RADIATOR MARKET (£M MSP) 2013-2022 64

- TABLE 31: UK COMMERCIAL HEAT EMITTER MARKET (£M MSP) 2013-2022 66

- TABLE 32: UK STAND-ALONE HEATER MARKET (£M MSP) 2013-2022 67

- TABLE 33: UK COMMERCIAL HEATING CONTROLS MARKET (£M MSP) 2013-2022 70

- TABLE 34: COMMERCIAL AND INDUSTRIAL BOILER SUPPLIERS % MARKET SHARES BY VALUE 2017 71

- TABLE 35: COMMERCIAL RADIATOR SUPPLIERS % MARKET SHARES BY VALUE 2017 74

- TABLE 36: HEAT EMITTER SUPPLIERS % MARKET SHARES BY VALUE 2017 75

- TABLE 37: WARM AIR HEATER SUPPLIERS % MARKET SHARES BY VALUE 2017 77

- TABLE 38: RADIANT HEATER SUPPLIERS % MARKET SHARES BY VALUE 2017 78

- CHART 39: MARKET DISTRIBUTION BY CHANNEL (DIRECT, DISTRIBUTOR) BY VALUE 2017 80

- TABLE 40: MARKET DISTRIBUTION BY APPLICATION TYPE (INDUSTRIAL, COMMERCIAL, PUBLIC) BY VALUE 2017 80

Paired Report Discount

Save £250 for every two reports you buy

Discount applied in basket

Frequently bought together

Trusted by industry leaders

For more detailed requests speak to our research experts directly

Research you can depend on

Our reports go deeper to give you the insights needed to make your next strategic move.

- Detailed assessment of the market – analysis of the market structure and recent developments within the market.

- Market prospects up to 4 years – market value, opportunities, impact of Covid-19, Brexit etc.

- Detailed information – market size, influences, market factors and key players.

- Analysis by product group – market size, product mix, sector trends etc.