What factors are driving the home improvement sector?

Richard Brace, Director of Barbour ABI delivered an insightful talk at the 2024 Materials & Finishes Show at the NEC. He highlighted many eye-opening statistics, with a focus on key drivers affecting the construction market – in particular the home improvement, and domestic repairs, maintenance and improvement (RMI) sectors.

How are economic factors affecting construction?

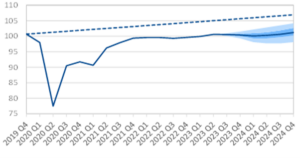

Using the graph below to support his statements, Richard evidenced that GDP has not recovered to expected levels. This has been largely affected by the pandemic, from which we’ve seen a gradual recovery, and the effect of the ill-fated mini budget. As GDP continues to recover though, Richard said we should start to see lowering of interest rates as a result.

Inflation has seen an upward trend, although there has been a sharp fall from its peak in October 2022. Richard highlighted that inflation directly affects factors in construction such as materials input costs, employee wages and distribution costs. In addition, the price of construction materials continues to be an issue. Richard said this is not only due to inflation, but also several macro-economic factors including:

- Wars in Ukraine and the Middle East pushing up energy prices, directly affecting the manufacturing of building materials.

- Chinese economy being unstable and unpredictable, which means there’s been a knock-on effect on the global supply and demand of materials.

Trade barriers and increased costs of imports caused by Brexit have also affected construction, alongside the issue of skilled workers returning to the continent.

What trends are we seeing in the construction industry?

Overall, the construction industry has good resilience, having seen 7.1% growth in 2023. This has been primarily fuelled by infrastructure and RMI, according to Richard.

Month-on-month, according to the latest Snap Analysis Report from Barbour ABI, the industry has generally seen growth, with dips witnessed in the residential and infrastructure sectors.

We’ve seen trends of construction projects being delayed or a lack of investment due to political instability. Richard said this has primarily been witnessed in the road, rail, mixed use industrial and media sectors.

Although the housing sector has been heavily affected by the rising interest rates, Richard said this means residents have been more inclined to stay put and improve their homes – leading to a strengthening RMI sector. Banks are beginning to show signs of moderating mortgage rates, so the state of the housing market is expected to improve in the medium term.

For further reading on the home improvement sector, our latest Home Improvement Index provides you with the latest facts and figures.

Residential new build vs RMI

2021 saw an increase in demand for new build residential due to the stamp duty threshold changes. The mortgage guarantee extension further stimulated the new build market in 2023 but is now seeing a decline in project starts due to economic uncertainty and the cost of living crisis.

Private residential RMI is thriving according to Richard, with extensions and renovations at a high level following increased home working post-pandemic. This has been prevalent in more rural areas, with the decreased need to commute. As a result of this, Richard said industry suppliers have had to rethink distribution processes to reach areas outside of the core cities.

Mortgage rate rises also mean people are looking to stay put, with the renovation over move trend being most popular in the over-55 demographic.

Planning regulations have also had an impact on RMI, with local restrictions and house prices leading to people selling up to cash-in within the higher value areas.

How are trends directly affecting construction companies and project output?

In the latest State of the Nation Report, Richard talked about industry concerns surrounding the ability to recruit skilled labour, with 67% saying they’re feeling the strain of recruitment which is hindering growth. With the post-Brexit effects, businesses are finding the need to backfill their skills gap with UK residents.

With insolvencies reaching a decade high peak, financial strains are being felt by businesses operating in the construction industry. Richard said this is a result of high interest rates discouraging investments and delaying approved projects.

Technological advancements within construction have been helpful in raising productivity of the design and delivery of products, according to Richard. This has also impacted sustainability agendas because although modern methods of construction (MMC) have received negative press, this has been a growing trend in the woodworking sector.

Construction has been at the forefront of the net-zero sustainability agenda with a particular focus on:

- Materials

- Energy efficiency

- Waste minimisation and management

- Supply chain and delivery

Businesses operating in the industry are now needing to have their own sustainability goals, which is affecting how businesses are being selected to be involved in projects.

Planning applications and pipelines are looking healthy, but awards are being delayed due to political (and therefore economic) uncertainty.

What is the long-term outlook in the construction industry?

Richard expected that post-2024, we should see growth in the industry. With planning approvals at a high level, this should lead to an eventual growth in awards. And with a new government by the end of the year, this tends to be followed by heavy investment in infrastructure alongside housing targets which need to be reached.

For residential new builds, growth is expected but is likely to fall short of the 300,000 annual target.

For further reading on the home improvement sector, our Home Improvement Index 2024 is the only guide to where, what and when activity is happening in British home improvement.

Recent Posts

- Key Trends and Market Dynamics in the UK Bricks, Blocks & Precast Concrete Sector

- Navigating Market Volatility: The Future of the UK Kitchen and Bathroom Distributors

- UK Kitchen and Bathroom Distribution: Growth, Challenges, and Opportunities

- Diesel Dominance and the Rise of Green Alternatives in the UK Generator Market

- From Diesel to Hybrid: Barbour ABI Maps UK Generator Hire Market Evolution